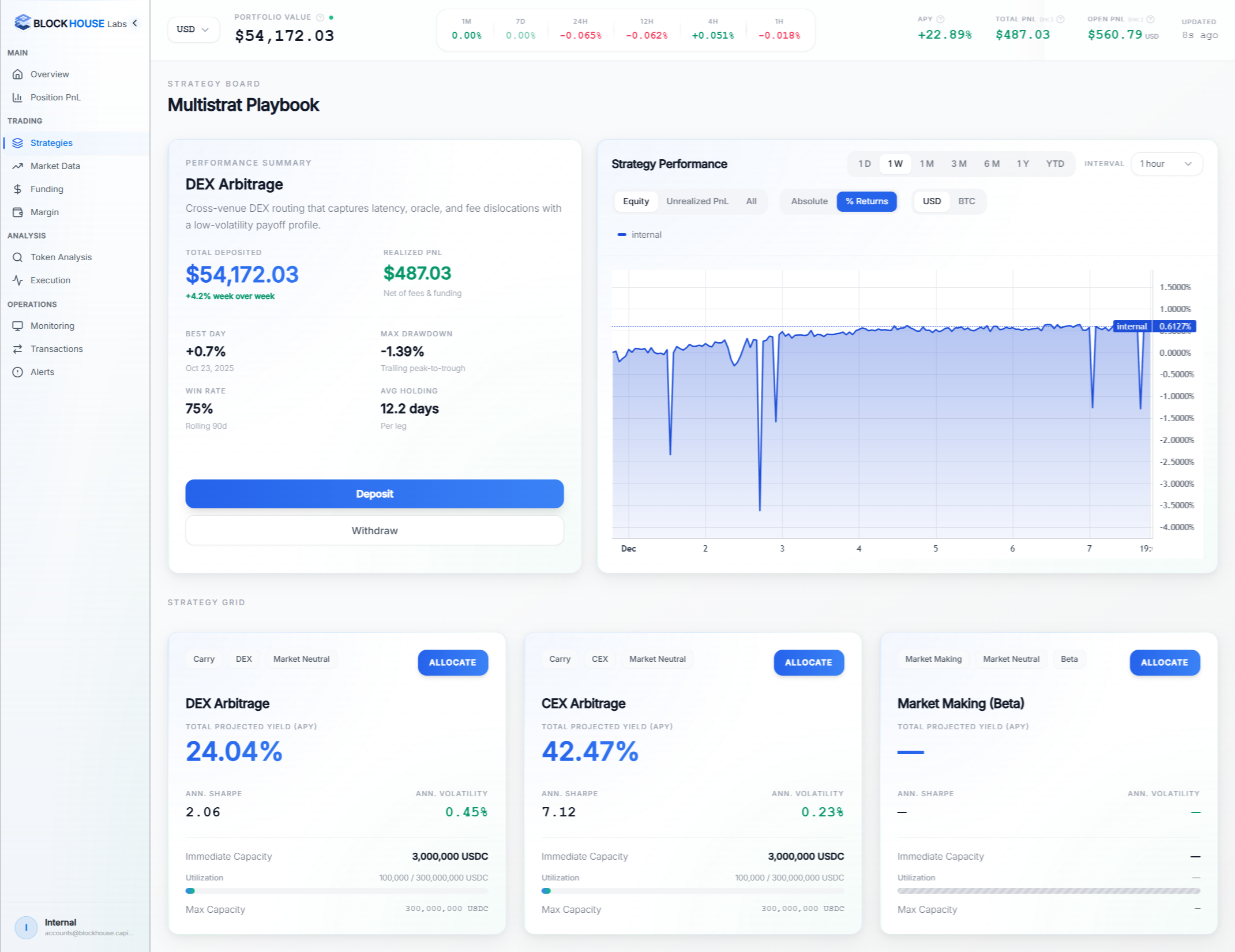

Blockhouse is built by traders and engineers for asset managers. Allocate seamlessly into fully automated, risk-adjusted strategies designed to capture inefficiencies in new exchanges, instruments, and products in digital asset markets

Building a scalable systematic trading operation demands years of engineering and millions in capital.

Data infrastructure. Alpha signal research. Exchange connectivity.

Blockhouse integrates these critical components into a single institutional platform, unlocking access to new systematic opportunities across the breadth of digital asset markets.

Blockhouse operates a systematic, delta-neutral strategy across decentralized perpetual futures markets, where AMM pricing and fragmented liquidity create persistent on-chain inefficiencies. We identify and capture these funding and basis spreads across leading DEX protocols using data-driven execution and disciplined liquidity-aware sizing.

Supported Exchanges

Get trading with algos in minutes, not months. You select your allocations, we execute

Complete our onboarding form with your information. Once approved, we'll email you to proceed to Step 2

Complete our onboarding form with your information. Once approved, we'll email you to proceed to Step 2

Log in to our secure portal and provide keys for your exchanges. We support 30+ exchanges, but do not custody capital or create accounts at new exchanges

Log in to our secure portal and provide keys for your exchanges. We support 30+ exchanges, but do not custody capital or create accounts at new exchanges

Hop onto our vaults page and take a look at the active strategies, performance, and risk allocation. Determine where to invest your capital and invest in a few clicks

Hop onto our vaults page and take a look at the active strategies, performance, and risk allocation. Determine where to invest your capital and invest in a few clicks

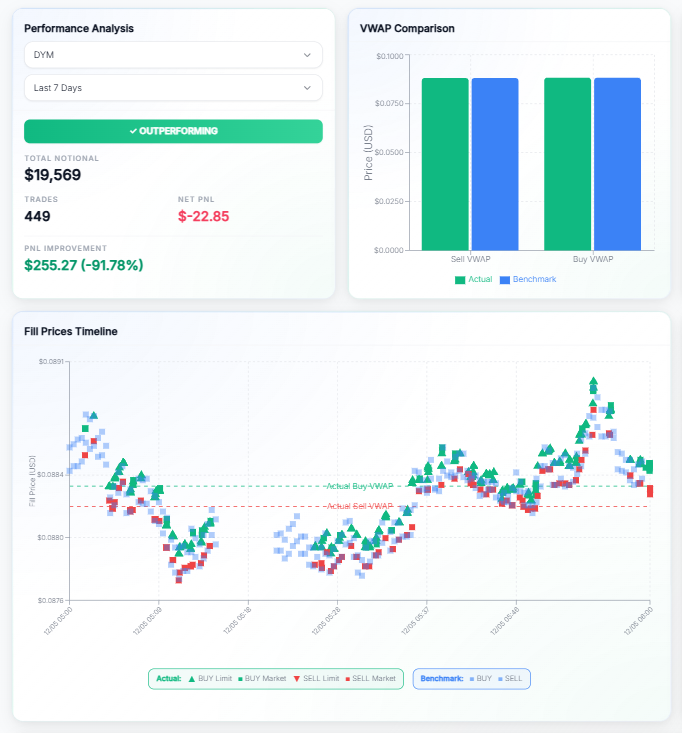

Access your dashboard to monitor PnL in real time, review detailed execution metrics, and evaluate token-level insights.

Access your dashboard to monitor PnL in real time, review detailed execution metrics, and evaluate token-level insights.

Watch the algorithm placing orders in real time on the order book with comparisons against exchange benchmarks and historical trades to make sure orders are executed as planned